Obligo is on a mission to build trust between landlords and renters. As such, we partner with a diverse range of landlords and property managers who own and manage residential portfolios across the nation. While we want to bring our deposit-free rental model to every household, we need to make sure we partner with the right portfolios and property managers.

Trust is the cornerstone of any successful business relationship. Third-party companies like PayPal, Airbnb, Uber and Obligo make it their business to ensure that trust isn’t violated, and to protect all parties from potential fraud or misuse. As such, Obligo is equally committed to protecting both landlords from bad-acting renters and renters from unfair practices by landlords. This commitment led us to develop a simple portfolio assessment process, to help us uncover any risks and understand each property’s practices.

What Is A Portfolio Assessment?

A portfolio assessment is a due diligence process Obligo uses to qualify any property owner or management company that wants to join our network and reap the benefits of deposit-free renting and other trust-building features from Obligo’s suite.

It starts with a short form where a potential partner discloses basic business information about their portfolio like unit count, rent range, screening thresholds and deposit policy (Do they charge the equivalent of one month’s rent? More? Less?). We also ask for their average move-out deposit deductions, and the percentage of deposits that are returned untouched.

“The portfolio assessment is the first peek into how a potential partner has handled security deposits historically. It allows us to make sure that we’re partnering with responsible landlords and property managers who treat their residents fairly, and it also ensures the long term sustainability of our business” said Omri Dor, Obligo’s Co Founder and COO. “If we work with slumlords, we lose money. Plain and simple.”

Key Factors We Look For In A Portfolio Assessment

Here are the main areas we look into:

% of Deposits Returned in Full

When a renter takes good care of their home, they should generally expect to receive their deposit back in full. When Obligo encounters a portfolio assessment which indicates that 100% of deposits receive a deduction, it can be a red flag. One possible issue could be that deductions are being made for “fair wear and tear” like cracked paint or worn carpeting (Most states have laws prohibiting landlords from deducting for fair wear-and-tear). Other times it can be turnover costs like ‘new keys’ that could have been paid at move-in, more transparently.

Average Deposit Deductions

Once it’s been established that the deduction practices are reasonable from a qualitative perspective, we turn to the most critical aspect of the assessment: what is the average security deposit deduction? How much are they actually charging every time a resident moves out? This data helps us understand the overall risk of the portfolio for Obligo.

Each portfolio type has different benchmarks that Obligo has learned over the years. For instance, we would generally expect higher deductions from a single-family rental portfolio, and the lowest on Class A multifamily. If the average deduction rate in a particular portfolio is much higher than our benchmarks, this would be a red flag. It’s sometimes hard or impossible to pinpoint why a portfolio’s deduction rates are high. It can be due to bad practices of the management company, or it could be a result of the risk profile of their renters. Either way, Obligo will likely lose money on this portfolio, which is why we would avoid it.

Turnover Rate

Another key factor in any portfolio is the turnover rate. Here, too, there are different benchmarks for multifamily, single-family, or student housing. When we see renewal rates above our benchmarks, it is a positive double whammy. Firstly, a high renewal rate tells us that the renters are generally happy with their physical unit, as well as with their property manager, which is why they choose to renew. Secondly, any lease that ended in renewal is a lease where Obligo didn’t lose any money.

“It almost sounds obvious, but if you think about it, a trusted third party’s business interests need to be aligned for all parties. In our case, this means our interests are truly aligned with both the landlord and the renter. ” Omri said. “We want happy renters who will renew their lease. And when it’s time for them to graduate to another home, we want them to leave a clean apartment without any unpaid debts.”

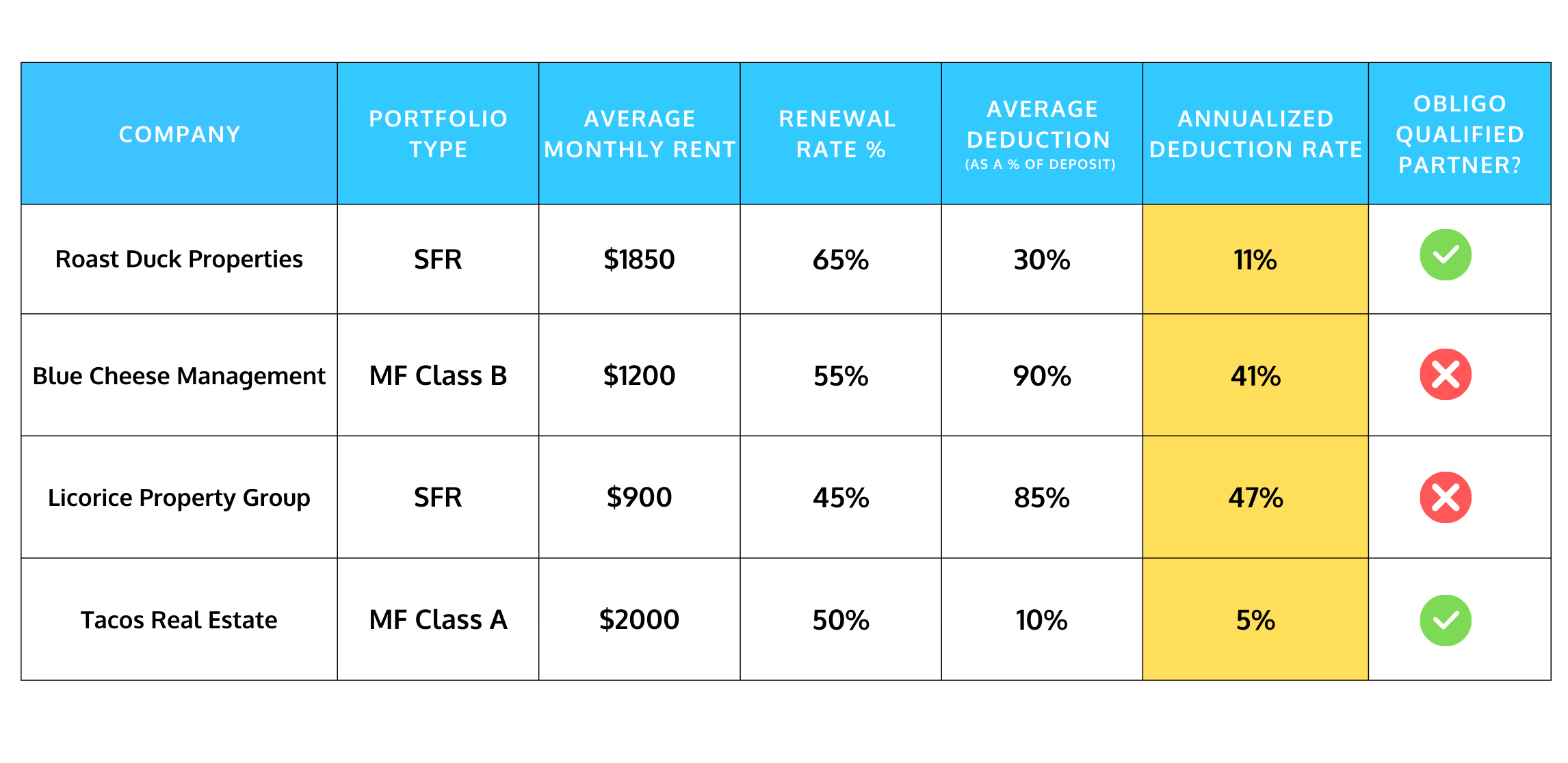

Our Qualification Benchmarks

Typically, Obligo would qualify portfolios whose average deduction rate falls below 35%. If the rate is between 35% and 50%, we would seek further context and keep a closer eye on their performance. We would turn away portfolios with a deduction rate above 50%.

We would then look at another metric, which considers the partner’s renewal rates:

Annualized Deduction Rate = (1 – % renewal rate) x Average Deduction rate

The Annualized Deduction Rate offers a more holistic view because it also considers a portfolio’s renewal rates. Single-family portfolios, for instance, have a higher deduction rate due to the sheer size of the home and the amount of items that can be damaged. However, single-family portfolios also have a higher renewal rate because families tend to stay in a home longer. By looking at Annualized Deduction Rates, we can have a better feel for the overall risk, and we can achieve better business alignment between ourselves and property managers.

Here are some fictional companies that would qualify to partner with Obligo:

Ongoing Monitoring

Once a partner has been vetted and onboarded, we extend full trust to that property management company. Obligo does not interfere with the partner’s day-to-day operations, and we don’t individually scrutinize any charges submitted against renters. Charges are essentially approved automatically and paid out to property managers in a matter of days.

While we always err on the side of extending trust, our mission and business compel us to monitor the actual performance of our portfolios on an ongoing basis. We monitor charge rates and renewal rates, which were part of the portfolio assessment. Once we’re live at a property, we also look at renter sentiment towards charges (we ask them to rate the fairness of each charge), along with their propensity to repay any charges.

With our larger partners, who have meaningful statistics within their own portfolio, we are able to share this ongoing performance data and compare it to benchmarks. We have repeatedly seen that our partners are exhilarated and very much up to the challenge of understanding how to better communicate with their renters, avoid unnecessary friction, and even generate positive reviews.

On rare occasions, despite the portfolio assessment process, and despite transparently sharing data with our partners, we could see anomalous behavior. It could be charge rates, it could be renter sentiment towards charges, or it could be something else. At this point, a question starts to form – should Obligo continue to work with this partner?

When this happens, Obligo remains committed to building trust between landlords and renters, and will follow these steps:

1. Investigate the issue with the partner

Our first step would be to have conversations with the partner to see if their business has changed in any way to cause the anomalies. For instance, has their resident application screening process changed or have they taken on a different class of properties? Obligo would also look at their charges more closely and share any findings with the partner. For instance, maybe the deductions are not property documented with evidence? Maybe the deductions are for ‘fair wear and tear’?

2. Share best practices

For any partner that cares about bringing down their charge rates and improving their resident experience, Obligo would work with them and share best practices. Some of the tips include:

– If there are fees you know you will always charge for, do it upfront and make it part of the move-in process (think cleaning fees, pet fees, key duplication fees etc.)

– Communicate expectations clearly when residents move in so they can avoid charges at move-out; Share a document outlining how the move-out process works and a ‘menu’ of common deductions

– If charges occur, be sure to share an itemized list of reasons with residents so they know what they are paying for. Supporting documentation can include photographs of damages, receipts for repairs, ledgers showing unpaid rent or fees, etc.

“If our partner follows best practices, then many of their residents should be able to leave their property without deductible damage or missed rent,” Omri said. “It’s all about basic empathy, setting expectations early, and clear communication.”

3. Stop accepting new deposit-free renters

If, despite everyone’s efforts, a portfolio continues to show signs of unexplained high charges, low renter sentiment, and low renter repayment of debt, Obligo would eventually stop accepting new deposit-free renters into that portfolio. This is exceedingly rare, thanks to the due diligence Obligo does before accepting a partner in the first place. To date, only a handful of partners had to stop accepting new deposit-free renters. Crucially, any existing deposit-free residents are not impacted, and Obligo will remain committed to operating their deposit-free rentals as usual, so as not to interrupt the partner’s business.

“It doesn’t mean that they won’t be able to use Obligo in the future again,” said Omri. “It means they need to find out what’s broken in their process and fix their charge rates over time, until we gain confidence that we can continue to work together.”

The Bottom Line

Obligo’s business only makes sense when we work with trusted landlords and renters. If Obligo lets a bad-apple renter live deposit-free at a partner’s property, Obligo will likely lose money. Similarly, if Obligo works with an abusive landlord, Obligo will also lose money.

Our process of portfolio assessments and ongoing monitoring is designed to ensure the sustainability of our business, and just as importantly: to ensure that we live up to our mission of building trust between landlords and renters.

Leave a Reply