Property management softwares often promise a paperless solution — manage move-ins and move-outs on the go, handle electronic payments, and more. But in 2022, property managers are still sending renters away to get cashier’s checks or money orders to pay for security deposits at move-in.

Cashier’s checks and money orders are standing in the way of a truly paperless rental process, adding operational burden for both the property side and the renter side. So why are they still a thing?

Why People Use Cashier’s Checks & Money Orders

Simply put, for trust and security.

Not all payment methods are created equal — cashier’s checks and money orders offer a higher level of security. A cashier’s check is an official check issued by a bank or credit union. Since the funds are guaranteed by the financial institution rather than an individual’s account, they are the preferred method of payment for large amounts, usually $1000 and above. A money order is similar, but for smaller amounts. Money orders are sold in many places, such as Walmart or the post office, but you can only get cashier’s checks from the bank.

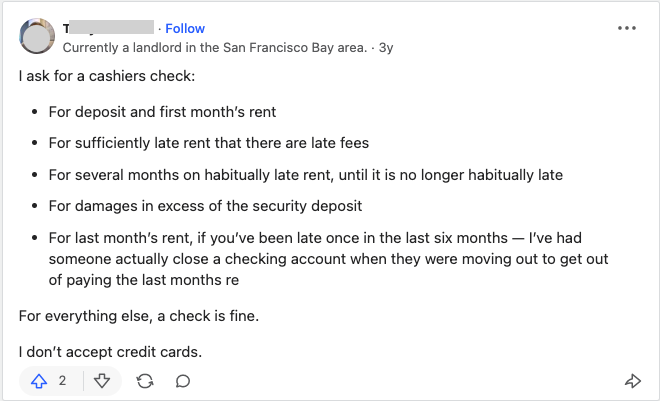

When renters move into a new home, their landlords or property management companies often require either of these two types of payments for security deposits and/or first month’s rent.

There are mainly three reasons for this:

– They are more secure than personal checks and most digital payments

With a personal check, or with digital equivalents such as ACH, there’s a risk that the payment will bounce and the landlord is left with a tenant who might not have sufficient funds to pay the full rent. There’s also a risk that the payment will be reversed or charged back even weeks after the transaction was supposedly cleared. Cashier’s checks and money orders provide a peace of mind because funds are guaranteed by the bank and cannot be clawed back.

– They’re cheaper than credit cards

Both cashier’s checks and money orders are cheaper than processing electronic payments via credit cards. For every credit card transaction, there’s a processing fee ranging from 1-4%. Assuming the deposit amount is $2000 and the processing fee is 3%, that’s $60 for each move-in.

– They can potentially save accounting hassle

Once collected, a cashier’s check can sit neatly in a drawer or a safe, and will only be deposited once the move-in is certain. If the renter ends up not moving in, the check can simply be returned to the renter. Since the money was never deposited into the landlord’s bank account, the accounting team doesn’t need to set up or take down a ledger for the renter.

It’s not hard to see the benefits of cashier’s checks and money orders from a landlord’s perspective. But are these payment methods really making lives easier for property managers? What are the downsides?

How Paper Checks Are Burdening Property Operations

If we look at the biggest challenges of property managers, move-in payment collection and handling paper checks at move-out are at the top of the list. These challenges are actually caused by the need for security and protection, specifically in the forms of:

1. Cashier’s Checks/Money Orders

While property managers can, in theory, save accounting hassle with cashier’s checks, they still present a host of manual challenges and admin effort. At move-in, property managers need to spend a lot of time providing customer support, which includes explaining cashier’s checks or money orders to applicants, meeting renters all over the city to receive and deposit checks, and manually updating their PMS. Moreover, sending prospective renters away to get these checks could delay the move-in process by days, and it’s proven to be one of the easiest ways to lose a deal.

2. Security Deposit Refunds

Security deposits are another roadblock to a truly paperless rental flow. Property managers not only need to collect them via cashier’s checks at move-in, but also print and mail physical refund checks at move-out. Chasing down forwarding addresses, waiting for check signers and issuing stop payments on lost checks cost plenty of admin time and effort. It’s a slow process that results in renter complaints and negative reviews on the property.

So, is there a way to handle rental payments and deposit refunds securely and effortlessly, without the hassle of paper checks?

A Truly Paperless Solution

Going deposit-free with Obligo helps streamline operations by eliminating paper from the rental flow entirely. With deposit-free living, renters can keep the cash to invest, save, travel, or spend as they please. If they choose to pay a traditional deposit, Obligo can also collect that deposit electronically, and automatically certify and settle those funds to the property.

Our ACH processing is free of cost and we guarantee delivery of the funds, which means owners and managers stay protected without needing to send applicants away to purchase the certified checks.

Similarly, refunding deposits electronically through Obligo is a great way to improve operational efficiency and simplify the move-out experience. Our Electronic Deposit Refund solution automates and accelerates traditional deposit refunds. Property managers no longer need to deal with the headaches associated with refund checks, and renters get their deposits back quickly, securely, right where they need them – in their bank accounts.

Ready to go 100% paperless in your rental operations, eliminate cashier’s checks and streamline security deposit management ? Contact us today!

Leave a Reply