If you have ever used a financial management tool or an investment app, you’ve probably benefited from open banking. In fact, 8 out of 10 U.S. consumers are already connecting their bank accounts to third-party apps, Mastercard’s open banking report shows.

Open banking-powered financial services weren’t always the mainstream. In the past, it was very hard to compete with banks for services like loans or mortgages, because they had an unfair advantage — access to your banking data, average balance, transaction history, income, and more.

“Open banking creates more competition and innovation in financial services by giving end users the right to choose if and how they want to share their financial data with an entity outside of the bank,” said Ori Zviran, Obligo’s Core Technology team and senior engineer. “As a result, a number of innovative services and applications came to life, helping consumers manage their finances, get cheaper loans, invest their money, and generally make their lives easier.”

At Obligo, we want to bring transparency and fairness into the rental qualification process, and help more renters qualify for deposit-free living. Open banking is key to achieving that goal.

How Obligo Uses Open Banking Data

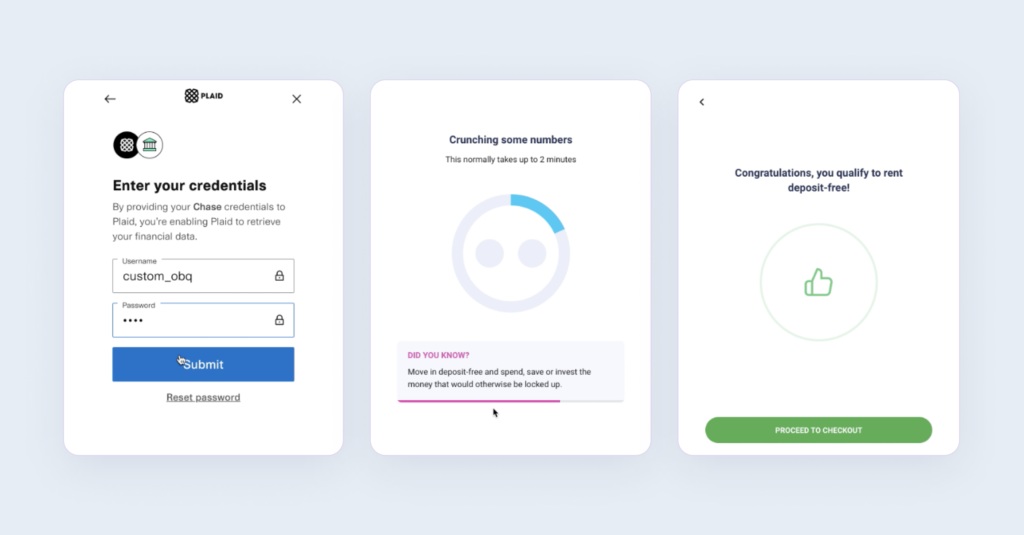

When residents connect their bank accounts to Obligo via Plaid, our machine learning model is able to build a financial profile for each of them. We then verify their incomes and evaluate their trustworthiness, to see if they could qualify for deposit-free living with Obligo’s secure Billing Authorization.

For every new applicant, our model analyzes the lease outcomes of past renters with similar financial profiles to them, and predicts whether these new renters will have sufficient funds to cover the full rent amount. Our model doesn’t look at renters’ personal details or credit scores. Instead, it looks at different features that could be good indicators of a renter’s risk level.

“For example, we can look at the average balance in your bank account in the last six months divided by your monthly rent,” said Omri Dor, Co-founder and COO of Obligo. “Is that number high or low? A low number means that there isn’t a lot of cash usually floating in your account, and that’s potentially a riskier situation. If there’s a lot of money floating around, usually that may mean that you are a safer renter. So we use these kinds of features.”

Top 3 Benefits of Open Banking

These 3 benefits of open banking are especially important to the home rental industry, and Obligo is harnessing all of them to make lives easier for property managers and renters.

1. It’s secure

Open banking as a practice is highly secure and trustworthy, and there are a lot of regulations in this space to ensure people’s data security. At Obligo, renters’ financial data is saved behind three layers of protection. It’s anonymized, encrypted, and inaccessible to anyone.

The majority of Obligo’s applicants already trust open banking: when given two options to qualify for deposit-free living — using micro-deposits or instant verification with open banking — 85% of our renters choose the latter.

2. It’s better than FICO

Traditionally, renters need to go through a credit check and a background check before they can be approved for a rental application. A low credit score alone can usually be a deterrent in this process, even if the renter has the means to pay the full rent.

Open banking data enables a more flexible and equitable way to screen applicants. For instance, it’s hard to improve your FICO score even when your overall finances are improving, but open banking allows Obligo to look at how renters are behaving financially, beyond just a credit score.

“We’re not looking at what you did 10 years ago or five years ago,” Ori said. “We’re building this based on one or two years of history, and we give different weights to specific timeframes. Our solution avoids the bias inherent in credit scores.”

Since Obligo handles the move-out process, we have visibility into the outcome of every lease, enabling a true machine learning cycle to take place. With the benefit of open banking data and lease outcomes from past renters, we get a more holistic, dynamic view of renters’ financial strength and trustworthiness.

“Our model is more of a real estate scoring system, because it’s really tailored to good renters who pay their rent on time,” Ori said. “We’re not dependent on a creditor to tell us if someone didn’t pay. It’s a more modern way of doing things.”

3. It saves time & money in the rental process

Obligo’s open banking enables instant income verification for new renters and qualifies them for our billing authorization. Both property managers and renters can save hours of time on paperwork, making the move-in experience simple and frictionless.

Typically, running credit check, background check and income verification costs around $15 for each renter. Managers of multifamily property with many units can significantly reduce costs by using Obligo’s open banking to verify renters, which boosts their bottom line as a result.

Between the increased operational efficiency, elevated resident experience and boosted bottom lines, open banking is a true gift for property managers who want to step into the future.

Leave a Reply