NOI, or net operating income, is an essential metric to evaluate how profitable a given property is. A high NOI usually indicates that the property is efficiently operated and will be worthy of investment.

Savvy owners and managers know that there are many ways to increase a property’s NOI, such as offering better amenities and finding new revenue streams. But sometimes all you need is a nimble solution that impacts multiple aspects of your rental operation, like offering deposit-free renting to your residents.

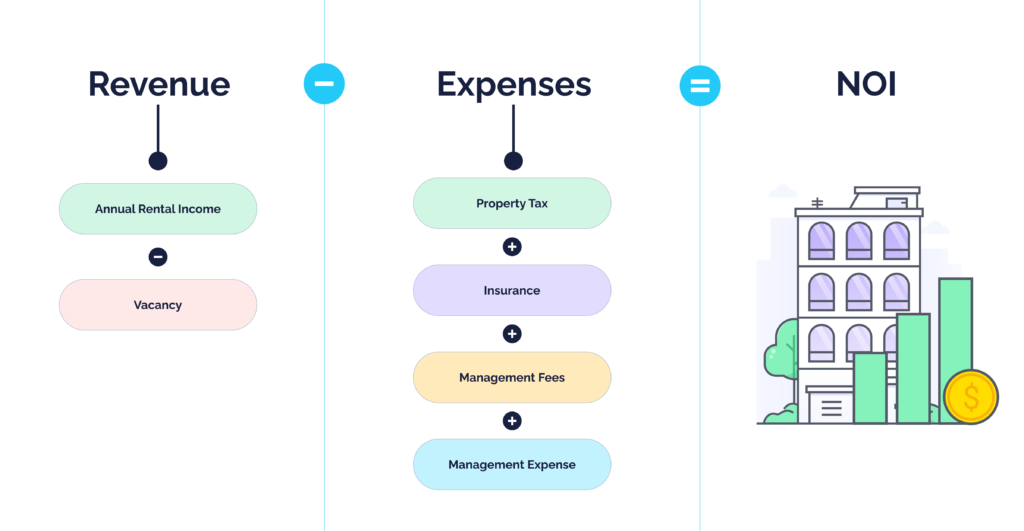

Before we dive into how deposit-free renting can benefit a property’s NOI, here’s a refresher for leasing teams that might not be as familiar with the metric.

How To Calculate Property NOI

Here’s the formula to calculate the net operating income. Income taxes and mortgage payments do not count as expenses in the equation.

Gross Revenue from Rental Property – All Necessary Operating Expenses = NOI

What Can Property NOI Do For You?

Secure financing

Suppose you’re a first-time owner, and you’re financing the property with a mortgage. Your creditor or lender – most likely a bank – will need to know whether you’re presenting them with a risky investment. If your building has a high NOI, which indicates good income generating potential, they’re more likely to finance it. NOI also helps lenders determine the size of loan they’re willing to offer you.

Strategize investment

Net operating income is also essential in the calculation of capitalization rate, or cap rate — the initial rate of return expected of an investment property. You get the cap rate by dividing a property’s NOI by its purchase price (value). The cap rate will help you compare different properties in local areas, and make strategic decisions on which to invest in, which to flip, and which to rent as is.

If you’re a property manager, NOI is also a key metric for evaluating new solutions to add to your management tech stack. Your owners will want to understand the potential impact these solutions will have on their net operating income.

How Deposit-Free Helps Boost Property NOI

There are four main ways deposit-free renting helps property owners and managers boost NOI:

1. Minimize bad debt

Some property owners elect to take a small deposit, such as $300, in order to remain competitive in their market. But they are left with less protection, and the burden of handling deposits remains. Owners who take smaller deposits often need to reconcile damages or missed rent that exceed the security deposit’s coverage amount. If a property manager charges a resident $400 at move out, but they have only collected a $300 deposit, they’re on the hook to recover the outstanding $100 balance. Failure to collect the funds will result in bad debt.

With debt collection rates topping out at 20%, according to the National Apartment Association, a property could expect to recover only $20 of the $100 owed. Obligo’s Billing Authorization can increase your security to one month’s rent or more, and your residents get to keep their deposit cash too. In the example above, this increased security would eliminate any bad debt.

Obligo will immediately initiate ACH payment for any move-out charge up to the Billing Authorization amount, and handle the full billing process. With Obligo’s deposit-free plan, you can minimize bad debt while staying protected, and your NOI will be made better for it.

2. Avoid unit turnover cost

Our data shows that offering deposit-free living creates a renewal incentive as powerful as a 3% rent discount, while renters are also 20% more likely to renew their lease. With this increased renewal rate, you would be able to save 20% on turnover costs.

Even in a white-hot rental market, unit turnover costs can stack up and hurt your bottom line. The national average cost of a single unit turnover is estimated to be $1,800, which includes inspection, cleaning, painting, maintenance, and marketing. There’s also rental revenue loss when a unit is unoccupied.

One way to combat this and boost renewal rates is to offer your residents an upgraded deposit-free lease when they renew. If residents sign up for Obligo’s deposit-free service, they will even get their previously paid security deposits back. Happy residents who stay in your property longer means reduced unit turnover cost for you, leading to a higher property NOI.

3. Speed up move-in timelines

Your property managers, or yourself, probably spend a lot of time during move-in to provide customer support, manually update PMS systems or handle paperwork and cashier’s checks. Going deposit-free with Obligo will give you a paperless workflow that can speed up the move-in timeline by up to four days. Four extra days of rent leads to 1% increase in your rental revenue annually, which could mean a 20x boost in your property’s value (assuming a 5% cap rate).

4. Reduce operational inefficiencies

Mailing deposit refund checks at move-out takes up a chunk of your team’s time. Going deposit-free can effectively eliminate this inefficiency. With Obligo’s fully integrated and paperless deposit-free solution, owners can reduce costs associated with deposit refunds, such as saving $20 on each check that’s returned and needs to be reissued due to unknown forwarding addresses.

Get Started with Deposit-Free

Deposit-free properties are quicker to lease, easier to manage and more attractive to renters. The right deposit-free program can help you stay competitive, reduce vacancies and most importantly, take your NOI to the next level.

Ready to boost your property’s NOI? Get in touch with Obligo today!

Leave a Reply