Real estate professionals all over New York State are still coming to grips with the full extent of this change. The most glaring changes have to do with a landlord’s ability to raise rent on rent-stabilized units, an issue that has received widespread coverage. One part which has received less attention until now, is how these new regulations affect security deposits.

The new security deposit regulations, which are already in effect, are expected to have a deep impact on the day to day operation of leasing teams, management teams, accounting teams, and banks across New York State.

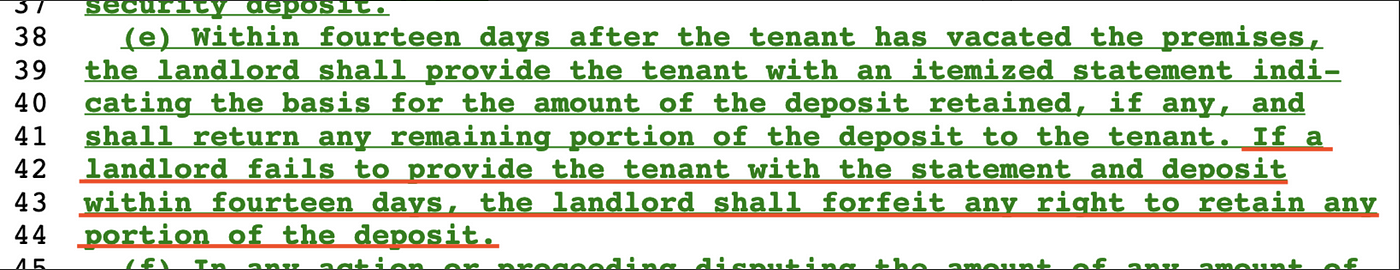

(Taken from the New York State Senate Assembly on June 11th, 2019)

(Taken from the New York State Senate Assembly on June 11th, 2019)

14 Day Deadline On Deposit Refunds

One of the new regulations dictates that deposits must be refunded within 14 days of lease end, alongside an itemized list on deduction. This seemingly simple and common sense regulation is in fact incredibly taxing and arguably impossible to comply with from an operational standpoint. The process of refunding deposits is very arduous, involving plenty of paper forms, multiple accounting procedures and several segments of snail mail. The complexity of refunding deposits stems in part from preexisting regulations which require each security deposit to be held in an individual interest bearing account on the tenant’s name. For most management and accounting teams, refunding 100% of deposits in under 14 days is practically impossible, definitely not during high season when the pressure is on.

One Month Cap On Security Deposits & Prepaid Rent

Security deposit sizes are now limited to one month, and it is no longer allowed to charge any prepaid rent. More precisely, prepaid rent is allowed but the total of the prepaid rent and the security deposit cannot exceed one month’s rent. While the law is not perfectly clear, it seems that the first month of rent can be charged ahead of move-in, but it would be due on the first day of the lease, not before.

New York State, and especially New York City, are full to the brim with expats, immigrants and other dwellers who have no rental or credit history. Until today, the landlord could allow such tenants to pay a larger deposit or prepay a few months of rent for extra security. With the new rent laws, these tenants are simply out of the question. The only option left to accept tenants with no credit history is for the landlord to agree to some kind of non-cash security. This could either be a guarantor or, as explained later in this article, a payment pre-authorization.

A Deposit-Free Paradigm

The taking, keeping and refunding of security deposits has arguably transformed from a mere operational burden to an operational impossibility and a very serious regulatory risk. The one piece of good news I can deliver is that Obligo might be able help.

Obligo is a platform for payment pre-authorizations, and it has the capacity to eliminate the burden of security deposits while keeping landlords secure and renters accountable. In properties where Obligo is enabled, tenants don’t pay a security deposit at all. Rather, renters provide a payment pre-authorization to their landlord, through Obligo’s platform. In the event of damages or missed rent, landlords can charge the tenant’s bank account up to the preauthorized cap, just as if there had been a security deposit. Obligo guarantees immediate payment to landlords on claims, while also offering tenants the flexibility of repaying claims in installments.

A key characteristic of the payment pre-authorization system is that it doesn’t only secure the landlord, but it also keeps the tenants accountable. As a result, the service is also very cheap, especially when compared to insurance based approaches. This cost effectiveness is critical because it allows Obligo to encompass entire properties at once. When the entire property is free from security deposits, compliance with the 14 day deadline becomes a non-issue.

As the dust of the new rent laws settles, management companies and landlords are all working hard on their compliance strategy, and in all cases they have serious concerns about the practicality of security deposits. It is hardly a surprise that, at Obligo, we are experiencing an unprecedented influx of calls and emails from prospective partners. These partners are no longer looking at Obligo as an amenity or as a tool to reduce admin and simplify processes. They are now looking at Obligo because it’s the only way for them to secure their leases while complying with the 14 day rule. And if this is the trigger that pushes us towards the tech-enabled and elegant deposit-free paradigm, then this could actually be a blessing in disguise.