Refunding traditional security deposits has long been an inefficient and burdensome process for property managers. For renters expecting to receive their cash back in a timely manner, deposit refunds can also be a source of frustration.

Despite the overwhelming majority of property owners and managers acting in good faith and working overtime to refund deposits, a steady stream of renters complaining about slow deposit refunds and incorrect forwarding addresses can be found on public review sites:

Source: Reddit

Source: Reddit

Source: Avvo

Source: Avvo

Source: Avvo

Source: Avvo

Not surprisingly, we also hear plenty of complaints from our partner communities who are forced to deal with uncashed security deposit checks, incorrect forwarding addresses and renters becoming unresponsive after they’ve moved-out. Refunding cash deposits has proven to be a major pain point for property managers, regardless of the number of units or properties in their portfolio.

The Increasing Regulatory Burden

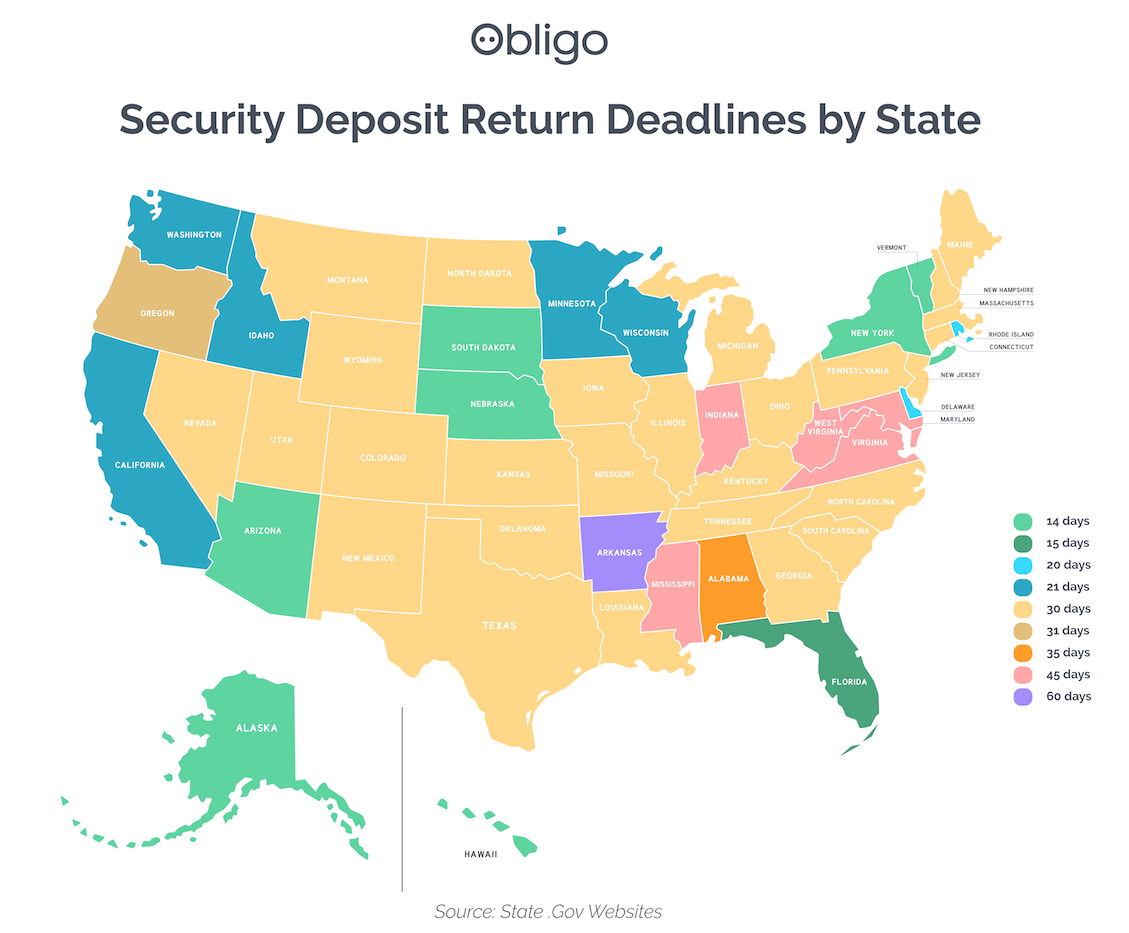

With ongoing regulatory changes impacting state deposit refund deadlines, the process is turning from a time-consuming burden to a full-fledged compliance risk. The deadlines vary considerably across state lines:

Of course, there are caveats to these timelines. In several states, the deadline can be extended if a tenant disputes deductions. On the flip side, the deadline can be accelerated if there are hazardous living conditions or if the lease otherwise dictates an agreed upon refund timeline.

In Connecticut for example, property managers have 30 days to refund a renter’s security deposit after move-out (or within 15 days of receiving the renter’s forwarding address, whichever is later). If the security deposit is not refunded with interest payments or with written detail on deductions, the property manager may have to pay the renter twice the amount of the deposit. Similar penalties exist in many states.

For late refunds that are pursued in a court of law, the stakes are clearly high and net operating income (NOI) can be materially impacted.

Recent Regulations Impacting Deposit Refunds

In Nevada, a bill was introduced earlier this year that would require property owners to refund security deposits within 21 days (rather than the current 30 day timeline). The bill also puts the burden of proof on the landlord to show any damage deductions went beyond normal wear and tear.

In Cook County, IL, an ordinance went into effect on June 1st, 2021 that requires security deposits to be refunded within 30 days (this ordinance also limits security deposits to no more than 1.5 month’s rent).

In 2019, New York State introduced its 14 day deposit refund rule, with 7 states across the country currently adhering to this deadline. For most management and accounting teams, refunding 100% of deposits in under 14 days is incredibly difficult, especially during peak rental season.

Depending on a property owner’s portfolio size, the process of refunding deposits can translate to thousands of administrative hours per year. For landlords with portfolios across multiple states, the deposit refund timelines and thus internal processes are becoming increasingly onerous.

A Faster Way to Refund Security Deposits

The most efficient and effective ways to meet state refund deadlines and avoid the issue of slow refunds and incorrect forwarding addresses:

1. Don’t take a security deposit (Obligo’s deposit-free service can help you here)

2. For traditional security deposits already in place, refund your deposits electronically.

Obligo now fully supports move-ins and move-outs for all renters, whether they qualify for Obligo’s deposit-free service or pay a traditional deposit.

Fully integrated with the leading property management software systems, Obligo’s Electronic Deposit Refund solution matches existing move-out accounting workflows to automatically process deductions and engage with renters until their deposit refund is reconciled. Funds are pulled directly from the landlord’s existing account structure, ensuring that the process is timely and compliant.

Renters use Obligo’s secure workflow to verify their identity, connect a bank account, and receive confirmation upon successful funds transfer. In the event of damages or other move-out charges, the platform helps landlords remain compliant by providing all the necessary disclosures to renters, including information about how to dispute unreasonable charges in accordance with the lease agreement and local laws.

Schedule a demo today and learn how you can automate your move-outs.

Leave a Reply