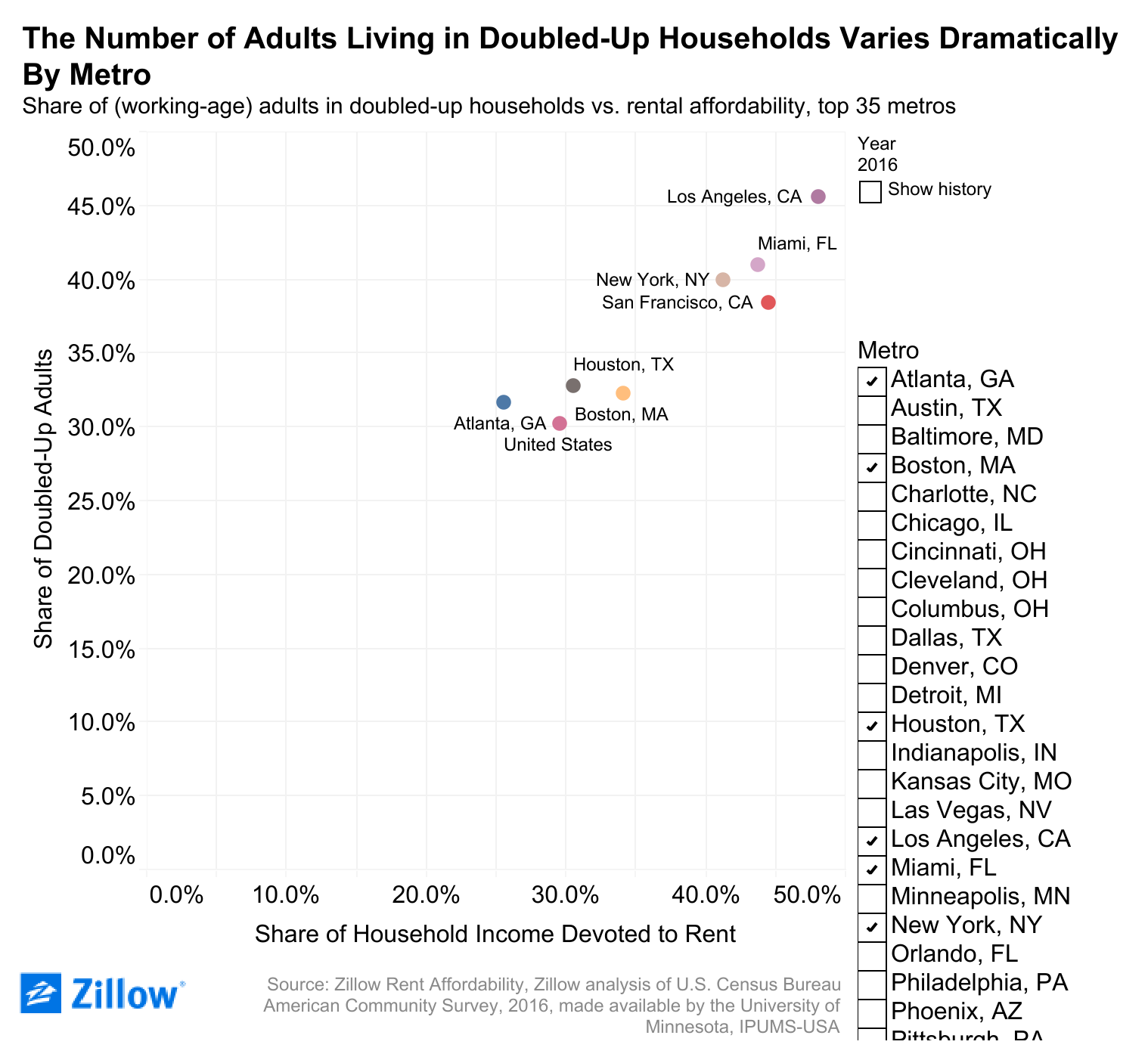

One of the most essential components of rental housing is having roommates. In 2016-2017, one in three adults in America still lived with roommates, or in doubled-up households. That percentage grows significantly in metropolitan areas like New York City (40%), Miami (41%) and Los Angeles (46%). Given the financial strain caused by COVID-19, the number of Americans living with roommates has likely increased even further in recent years.

There are many benefits to having roommates, such as splitting rent and having company. But the shared rental lifestyle has its share of issues – money, for one, can cause rifts between roommates, especially those who are not already familiar with each other.

A survey of 1,000 Americans shows that 42.8% of roommates are only acquaintances or even complete strangers before living together. Splitting rent, security deposits and other move-in payments when you don’t even know the person requires a lot of trust.

Move-out doesn’t get easier: roommates might disagree on the amount of security deposit refund they are each entitled to or who caused the damages charged. If one roommate leaves in the middle of the lease and a new tenant moves in, who gets the security deposit refund can become quite confusing.

These issues are challenging for both renters and their landlords. There are two main problems with the current deposit refund process for units shared among roommates:

1. Wasted Admin Time

Refunding traditional security deposits, shared unit or not, has long been an inefficient and burdensome process for property managers. They are often forced to deal with uncashed security deposit checks, incorrect forwarding addresses and renters becoming unresponsive after they’ve moved out.

Now add in multiple roommates and the time spent sorting out deposit refunds doubles or even triples. Some landlords send a check to the lead renter on the lease, but others might address the check to all renters, or send separate checks, each with a different forwarding address. Depending on a property owner’s portfolio size, the process of refunding roommate deposits can translate to thousands of administrative hours per year.

For renters expecting to receive their cash back in a timely manner, deposit refunds can also be a source of frustration. For instance, if the deposit refund check is addressed to multiple ex-roommates who now live far away from each other, cashing the check becomes a headache because most banks require everyone’s signature.

2. Compliance Risk

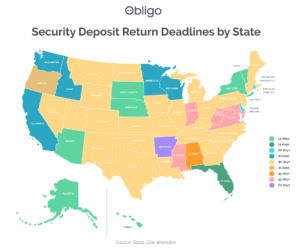

The time-consuming process of refunding security deposits can quickly turn into a compliance risk because of ever-changing rules around deposit refund deadlines. Depending on which state you’re in, the mandatory refund deadlines vary considerably:

New York and six other states must refund security deposits within 14 days after renters move out, the strictest timelines in the country. There are certain caveats – Arizona excludes weekends and legal holidays, and Alaska allows 30 days if tenants don’t give proper notice to end their tenancy – but for most management and accounting teams, refunding 100% of deposits in under 14 days is incredibly difficult, especially during peak rental season. In the case that multiple roommates have separate leases, property managers need to track down all of their forwarding addresses, which becomes even more challenging.

How Obligo Can Help

1. Refund security deposits electronically

To comply with state refund deadlines and reduce admin hours, property owners and managers can consider refunding deposits electronically, which provides a significant operational advantage over mailing paper checks, especially when co-tenancy is concerned.

Fully integrated with the leading property management software systems, Obligo’s Electronic Deposit Refund solution will make chasing down renters a thing of the past. It matches existing move-out accounting workflows to automatically process deductions and engage with renters until their deposit refund is reconciled.

In the event of damages or other move-out charges, the solution helps landlords provide all the necessary disclosures to renters, including how to dispute unreasonable charges in accordance with the lease agreement and local laws.

To establish higher levels of trust and transparency, our upcoming EDR Roommate feature will allow the refunds to be split evenly among roommates. The solution can also seek electronic endorsements from all roommates before refunding to the lead renter.

This way, every resident on a lease can use Obligo’s secure workflow to verify their identity, connect a bank account, and receive confirmation upon successful funds transfer. Their improved resident experience will be an extra value-add for landlords as well.

2. Offer your residents deposit-free living

The most effective solution to the deposit refund problem, roommates or not, might just be taking security deposits out of the rental process. Deposit-free properties are quicker to lease, easier to manage, and more attractive to residents.

Many property owners and managers are already saving countless hours of administrative time with Obligo’s deposit-free technology, which keeps them secure and their tenants accountable. At properties that offer Obligo, over 70% of renters choose to live deposit-free.

Obligo now fully supports move-ins and move-outs for all renters, whether they use Obligo’s deposit-free service or pay a traditional deposit. Schedule a demo today to learn how our holistic suite of deposit solutions can power a better experience for your residents!

Conclusion

Ever since COVID normalized the remote lifestyle, people started spending a lot more time at home and learned to appreciate having company in their living quarters. Whether they live with family, partners or even strangers, a trusting roommate relationship is pivotal to everyone’s well-being.

To establish deeper trust and avoid financial disputes, renters can sign a “roommate agreement” or have their landlords put a separate clause into the actual lease agreement. For landlords, it would be helpful to explain joint and several liability to tenants, which means that all the tenants on one single lease, and each of them, can be held responsible for all money damages incurred. Clarifying accountability will save everyone time and energy – so will using a seamless deposit refund platform like Obligo’s. Schedule a demo to learn more!

Leave a Reply