Originally published by Propmodo on September 28th, 2021.

A security refund process without frustration and disappointment is unexpected for renters. Jump into any review site and you’ll find horror stories about security deposits’ journey back to their rightful place. Renters are quick to blame management companies, threaten lawsuits, and caution anyone planning to move into their old building to rethink their decision.

Me emailing my previous landlord because I have not received my security deposit in the mail yet pic.twitter.com/ba51OWvWGS

— unbelievable ennui (@loombyloom) September 9, 2021

However, security deposits can be equally painful to property managers. Although the majority have good intentions and processes in place to refund deposits accurately and efficiently to their renters, it’s not a simple undertaking despite its regular occurrence. Many states require that deposits are put into a trust account, creating one more bank statement to keep track of. Refunding deposits can be delayed by incorrect forwarding addresses, unresponsiveness of renters after move-out, or other unforeseen events. As regulatory changes move-up refund deadlines, the obligations evolve into compliance risks.

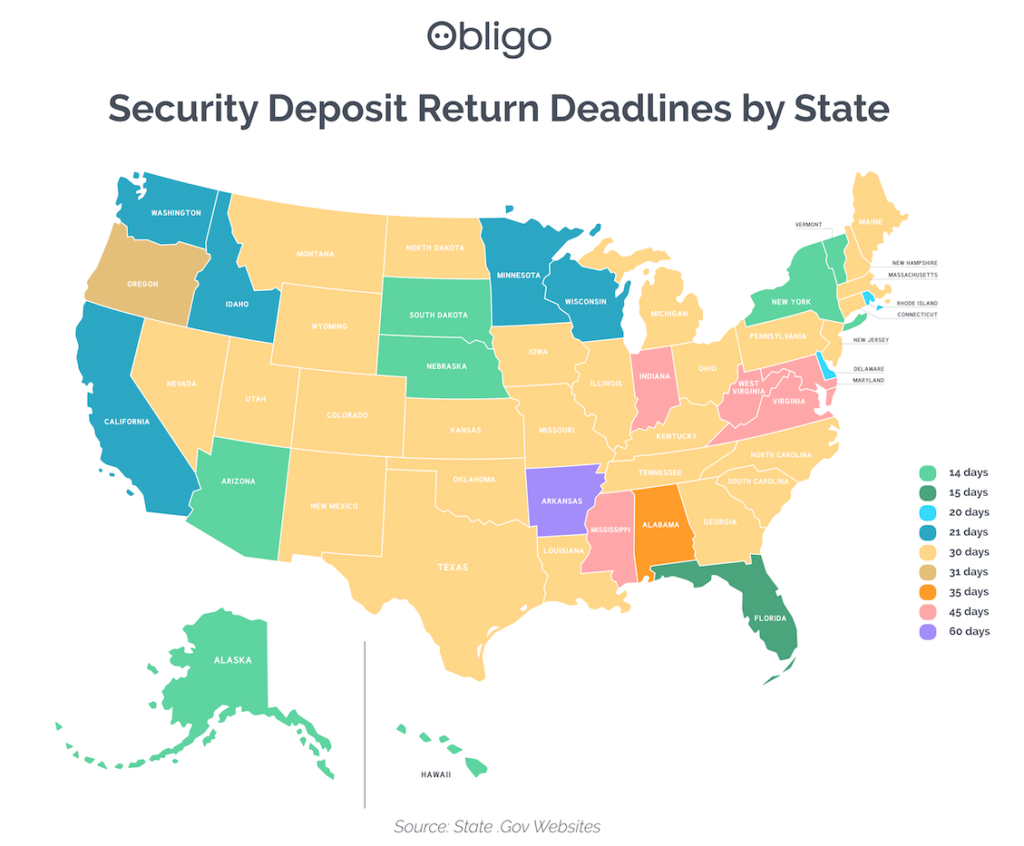

These laws vary greatly by location. Some states, like Arkansas, have a 60-day refund window while the majority of the United States abides by 30 days. New York recently lowered its required return time to just 14 days, leaving many landlords feeling stressed. “New York doesn’t make it easy to refund deposits. Once you have the deposit, you have to open an escrow account at a local bank and often this must be done in person,” explained Casey Winter, Vice President of Partnerships at Obligo, provider of a holistic suite of financial move-in and move-out solutions to streamline leasing and accounting operations, boost NOI, improve resident experience, and comply with deposit regulations. Winter continued, “Landlords then have to disclose that action to the renter and collect a W9 in case interest accrues.” New York also requires a separate account for each deposit which can lead to an obnoxious and burdensome process.

Source: https://myobligo.com/blog/why-slow-security-deposit-returns-are-a-challenge-for-both-renters-and-landlords/

Security deposits have the unique characteristic of potentially being painful for both sides of the transaction. “Legislation around security deposits has gotten in the way of efficiency,” said K. David Meit, CPM Principal at Oculus Realty, a full-service real estate firm that provides property management of investment properties. “Every jurisdiction is a little different. Some require that you pay interest every six months and the government sets that interest. Going back to the great recession, you’re required to pay a three or four percent interest and you’re earning 0.2 percent. Add in all of the tracking and spreadsheets, and it has become too onerous of a process.”

The pandemic heightened financial woes for many and, as of July of this year, only 10 percent of the $47 billion appropriated by Congress has reached tenants and landlords. With many individuals working with tight budgets and management companies trying to stay out of the red, renters need their deposits back and buildings need to fill vacancies. Q2 2021 vacancy rates are at 6.8 percent for rental housing in the United States, according to the most recent Census report, and property managers are looking for ways to expedite move-ins with high-quality tenants. However, many people cannot put down a new security deposit without the return of their previous one.

Requirements in the rental landscape are not the same as they were 18 months ago. “COVID-19 has completely changed the way people are renting and thinking about finding a new apartment,” explained Eric Rodriguez, Senior VP of Operations at Common, an operating platform for multifamily buildings. “All of the moving struggles, frustrating fees, and poor service that may have been seen as a “rite of passage” for renting in a big city are gone.” Today’s renters are asking for more and are proactively seeking out security deposit alternatives when looking for a new place.

Remote work and social distancing forced the acceleration and acceptance of removing old methodologies, both for landlords and renters. “Even if we didn’t want to use electronic checks, we had to figure it out and now people are more comfortable,” added Winter. In an industry where many of the renting processes are shockingly similar to how they were 30 or 40 years ago, change takes time. After all, the multifamily market is large, fragmented, and rather unfamiliar with more updated ways of getting things done.

What’s the fix? Much like other industries, the answer likely lies in innovative technology and accepting the consumerization of the rental process. “The new saying in Silicon Valley is that every company will be both a software and a fintech company,” said Andrew Firestone, Co-founder of Watson, a company offering a suite of smart software, data, and financial tools. “This has played out broadly in ‘high tech,’ but real estate is always behind the curve in terms of innovation.”

The challenge of security deposits is one felt on both ends of the rental process, one where technology could enhance the experience for all involved. According to Obligo data, the average security deposit refund takes three hours of work. Multiply that by the number of rental units under management and this task could easily become a full-time job. Technology that automates processes while building trust between tenants and their landlords not only saves time but attracts new tenants. Plus, existing tenants feel safe about where their money is and when, if the time comes, they’ll get their deposit back.

Younger and more tech-savvy generations are becoming the majority of renters. Deposit-free solutions that offer a limited, secure, and authorized connection to a bank account will be more appealing to, if not requested by, these renters. Younger generations are also more comfortable talking about finances as the taboo quality of the topic fades. This transparency allows for greater education about how to manage finances but also discovering alternatives to traditional methods.

The competitiveness of rental housing is increasing and renters are more apt to choose a home that is appealing beyond typical amenities. The security deposit space is ripe for disruption and, thankfully, options already exist for those in the market. These options include cashless deposit solutions that use AI-based qualification and open banking technology to analyze risk beyond normal parameters. Learning about how to automate security deposit refunds can be as easy as requesting a demo. All it takes is a bit of education and confidence in tech for both sides to experience a whole lot of relief.

Leave a Reply